YIELDDISC Function

The YIELDDISC function is one of the financial functions. It is used to calculate the annual yield of a discounted security.

The YIELDDISC function syntax is:

YIELDDISC(settlement, maturity, pr, redemption,[, [basis]])

where

settlement is the date when the security is purchased.

maturity is the date when the security expires.

pr is the purchase price of the security, per $100 par value.

redemption is the redemption value of the security, per $100 par value.

basis is the day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. It can be one of the following:

| Numeric value |

Count basis |

| 0 |

US (NASD) 30/360 |

| 1 |

Actual/actual |

| 2 |

Actual/360 |

| 3 |

Actual/365 |

| 4 |

European 30/360 |

Note: dates must be entered by using the DATE function.

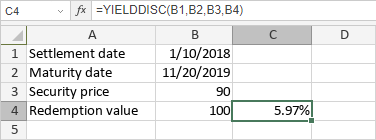

The values can be entered manually or included into the cell you make reference to.

To apply the YIELDDISC function,

- select the cell where you wish to display the result,

-

click the Insert function icon situated at the top toolbar,

or right-click within a selected cell and select the Insert Function option from the menu,

or click the icon situated at the formula bar,

- select the Financial function group from the list,

- click the YIELDDISC function,

- enter the required arguments separating them by commas,

- press the Enter button.

The result will be displayed in the selected cell.

Alla pagina precedente