PRICEMAT Function

The PRICEMAT function is one of the financial functions. It is used to calculate the price per $100 par value for a security that pays interest at maturity.

The PRICEMAT function syntax is:

PRICEMAT(settlement, maturity, issue, rate, yld[, [basis]])

where

settlement is the date when the security is purchased.

maturity is the date when the security expires.

issue is the issue date of the security.

rate is the security interest rate at the issue date.

yld is the annual yield of the security.

basis is the day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. It can be one of the following:

| Numeric value |

Count basis |

| 0 |

US (NASD) 30/360 |

| 1 |

Actual/actual |

| 2 |

Actual/360 |

| 3 |

Actual/365 |

| 4 |

European 30/360 |

Note: dates must be entered by using the DATE function.

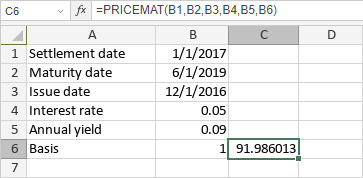

The values can be entered manually or included into the cell you make reference to.

To apply the PRICEMAT function,

- select the cell where you wish to display the result,

-

click the Insert function icon situated at the top toolbar,

or right-click within a selected cell and select the Insert Function option from the menu,

or click the icon situated at the formula bar,

- select the Financial function group from the list,

- click the PRICEMAT function,

- enter the required arguments separating them by commas,

- press the Enter button.

The result will be displayed in the selected cell.

Alla pagina precedente