ODDFPRICE Function

The ODDFPRICE function is one of the financial functions. It is used to calculate the price per $100 par value for a security that pays periodic interest but has an odd first period (it is shorter or longer than other periods).

Syntax

ODDFPRICE(settlement, maturity, issue, first_coupon, rate, yld, redemption, frequency, [basis])

The ODDFPRICE function has the following arguments:

| Argument |

Description |

| settlement |

The date when the security is purchased. |

| maturity |

The date when the security expires. |

| issue |

The issue date of the security. |

| first_coupon |

The first coupon date. This date must be after the settlement date but before the maturity date. |

| rate |

The security interest rate. |

| yld |

The annual yield of the security. |

| redemption |

The redemption value of the security, per $100 par value. |

| frequency |

The number of interest payments per year. The possible values are: 1 for annual payments, 2 for semiannual payments, 4 for quarterly payments. |

| basis |

The day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. The possible values are listed in the table below. |

The basis argument can be one of the following:

| Numeric value |

Count basis |

| 0 |

US (NASD) 30/360 |

| 1 |

Actual/actual |

| 2 |

Actual/360 |

| 3 |

Actual/365 |

| 4 |

European 30/360 |

Notes

Dates must be entered by using the DATE function.

How to apply the ODDFPRICE function.

Examples

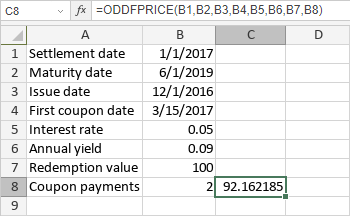

The figure below displays the result returned by the ODDFPRICE function.

Return to previous page