ODDLYIELD Function

The ODDLYIELD function is one of the financial functions. It is used to calculate the yield of a security that pays periodic interest but has an odd last period (it is shorter or longer than other periods).

Syntax

ODDLYIELD(settlement, maturity, last_interest, rate, pr, redemption, frequency, [basis])

The ODDLYIELD function has the following arguments:

| Argument |

Description |

| settlement |

The date when the security is purchased. |

| maturity |

The date when the security expires. |

| last_interest |

The last coupon date. This date must be before the settlement date. |

| rate |

The security interest rate. |

| pr |

The purchase price of the security, per $100 par value. |

| redemption |

The redemption value of the security, per $100 par value. |

| frequency |

The number of interest payments per year. The possible values are: 1 for annual payments, 2 for semiannual payments, 4 for quarterly payments. |

| basis |

The day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. The possible values are listed in the table below. |

The basis argument can be one of the following:

| Numeric value |

Count basis |

| 0 |

US (NASD) 30/360 |

| 1 |

Actual/actual |

| 2 |

Actual/360 |

| 3 |

Actual/365 |

| 4 |

European 30/360 |

Notes

Dates must be entered by using the DATE function.

How to apply the ODDLYIELD function.

Examples

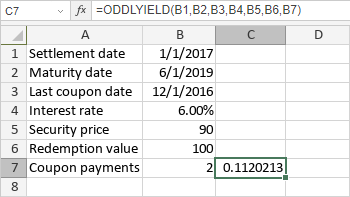

The figure below displays the result returned by the ODDLYIELD function.

Return to previous page