- Home

- COUPDAYS function

COUPDAYS function

The COUPDAYS function is one of the financial functions. It is used to calculate the number of days in the coupon period that contains the settlement date.

Syntax

COUPDAYS(settlement, maturity, frequency, [basis])

The COUPDAYS function has the following arguments:

| Argument | Description |

|---|---|

| settlement | The date when the security is purchased. |

| maturity | The date when the security expires. |

| frequency | The number of interest payments per year. The possible values are: 1 for annual payments, 2 for semiannual payments, 4 for quarterly payments. |

| basis | The day count basis to use, a numeric value greater than or equal to 0, but less than or equal to 4. It is an optional argument. The possible values are listed in the table below. |

The basis argument can be one of the following:

| Numeric value | Count basis |

|---|---|

| 0 | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Notes

Dates must be entered by using the DATE function.

How to apply the COUPDAYS function.

Examples

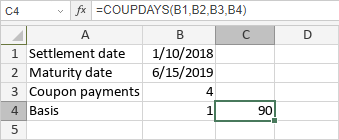

The figure below displays the result returned by the COUPDAYS function.

Host ONLYOFFICE Docs on your own server or use it in the cloud

Article with the tag:

Browse all tags